Some Of Empower Rental Group

Table of ContentsEmpower Rental Group Fundamentals ExplainedThe Single Strategy To Use For Empower Rental GroupThe Main Principles Of Empower Rental Group Getting The Empower Rental Group To WorkUnknown Facts About Empower Rental Group

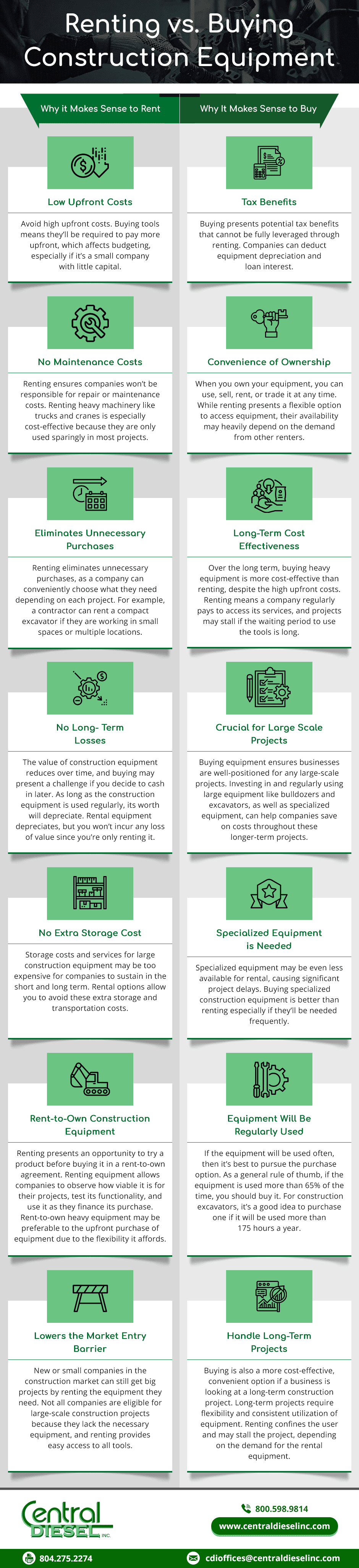

Think about the primary variables that will certainly assist you determine to acquire or lease your construction tools. https://medium.com/@empowerrentalgroup30103/about. Your existing financial state The sources and abilities offered within your business for supply control and fleet management The costs connected with buying and exactly how they contrast to leasing Your demand to have tools that's available at a moment's notice If the owned or leased tools will certainly be made use of for the appropriate size of time The most significant determining aspect behind renting out or acquiring is exactly how frequently and in what fashion the hefty tools is made use of

With the numerous usages for the plethora of construction equipment items there will likely be a couple of equipments where it's not as clear whether renting out is the very best alternative monetarily or acquiring will certainly offer you far better returns in the long run - heavy equipment rental. By doing a couple of simple calculations, you can have a respectable idea of whether it's ideal to rent out building devices or if you'll obtain one of the most gain from acquiring your devices

There are a variety of various other variables to consider that will certainly enter play, but if your company uses a particular item of devices most days and for the long-term, after that it's likely easy to establish that an acquisition is your best means to go. While the nature of future jobs may transform you can determine a best hunch on your usage price from current usage and forecasted tasks.

The 45-Second Trick For Empower Rental Group

We'll speak about a telehandler for this example: Consider making use of the telehandler for the previous 3 months and get the variety of full days the telehandler has been made use of (if it just finished up getting used part of a day, after that include the parts as much as make the matching of a complete day) for our example we'll say it was utilized 45 days (https://www.whatsyourhours.com/usa/business-services/empower-rental-group). equipment rental company

The utilization price is 68% (45 divided by 66 equates to 0.6818 increased by 100 to get a percent of 68). There's absolutely nothing incorrect with forecasting use in the future to have a best assumption at your future application rate, specifically if you have some bid potential customers that you have a great chance of obtaining or have actually projected jobs.

The Basic Principles Of Empower Rental Group

If your use price is 60% or over, acquiring is normally the very best choice. If your utilization rate is between 40% and 60%, then you'll want to consider exactly how the other elements associate to your service and consider all the benefits and drawbacks of possessing and renting out. If your application price is listed below 40%, leasing is normally the most effective option.

You'll always have the equipment at your disposal which will be ideal for current work and additionally permit you to with confidence bid on jobs without the worry of protecting the devices required for the task. You will have the ability to make use of the substantial tax obligation reductions from the preliminary purchase and the annual prices associated with insurance coverage, depreciation, lending interest settlements, repair services and maintenance prices and all the added tax paid on all these associated prices.

Some Known Factual Statements About Empower Rental Group

If you are thinking about methods that might expand your service after that concentrating on fleet management would be a sensible method to go. Given that it includes a various set of organization skills to handle a fleet, like transportation, storage space, service and maintenance, and various other facets of stock control, you could comply with the fad of creating a different department or a separate company simply for your equipment administration.

The noticeable is having the suitable funding to acquire and this is probably the top problem of every business owner. Also if there is capital or debt available to make a major acquisition, no person wishes to be purchasing devices that is underutilized. Changability tends to be the norm in the building market and it's hard to really make an informed decision regarding feasible tasks 2 to 5 years in the future, which is what you require to consider when buying that must still be benefiting your profits five years later on.

Unknown Facts About Empower Rental Group

While there are a number of tax deductions from the purchase of new devices, leasing costs are likewise an audit reduction which can often be passed on directly to the customer or as a basic overhead. They provide a clear number to help estimate the exact price of tools usage for a work.

You can't be specific what the market will be like when you're eager to sell. There is warranted concern that you will not obtain what you would certainly have anticipated when you factored in the resale value to your acquisition decision five or 10 years earlier. Even if you have a little fleet of devices, it still requires to be properly procured one of the most set you back savings and keep the tools well kept.